This article is from the Australian Property Journal archive

CROMWELL Property Group has offloaded its Brisbane office tower headquarters for $108.5 million, as well as a Village Cinemas in Geelong and a Canberra building leased to the Therapeutic Goods Administration (TGA), as part of its selldown of non-core assets.

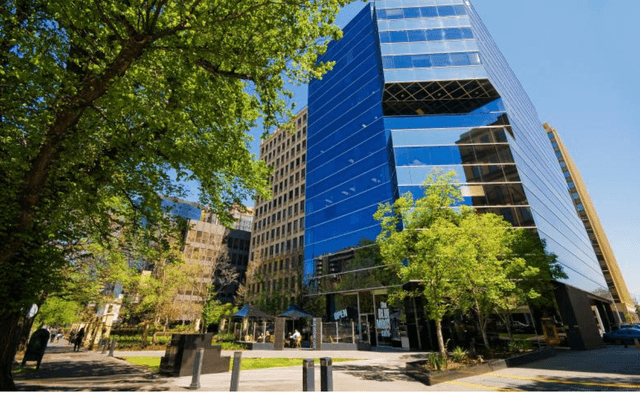

The sale of 200 Mary Street in the Golden Triangle precinct to Wingate was struck at an 8.1% premium to book value. The 13,352 sqm, 20-storey B-grade building boasts views over the Brisbane River, hinterland and the CBD.

Cromwell has actively managed the asset since it was acquired from AMP in 2001, progressively refurbishing and modernising the B-grade building in that time.

The move is part of the ASX-listed real estate investor and fund manager’s strategy to sell non-core assets and transition to a capital light funds management business, while launching new funds. Last month, it bought the Chesser House tower in Adelaide’s CBD for $81.35 million for an unlisted fund that had recently bought Brisbane CBD pair 545 Queen Street for $117.5 million and 100 Creek Street for $184.7 million.

Cromwell will remain headquartered at 200 Mary Street on a lease until March 2024. Secure Parking and Logicamms are among the other tenants.

“We have created significant value through repositioning the asset and, with high-quality tenants and long-term leases in place, now is the right time to capture significant upside and unlock the value Cromwell has achieved,” Cromwell’s chief investment officer, Rob Percy said.

CBRE’s Peter Chapple, Bruce Baker and Tom Phipps managed the transaction.

Cromwell has also just sold off the Village Cinema Centre in Geelong for $19.775 million and exchanged contracts on the TGA complex in Canberra’s Symonston, releasing over $140 million of capital that the group will use to reduce gearing prior to reinvestment in more strategically-aligned initiatives.

Both 200 Mary Street and the Symonston facility sales are expected to settle before the end of June.

In the Golden Triangle precinct earlier this year, Dexus, as part of its own portfolio selldown, sold the 12 Creek Street building known as the Blue Tower for $420 million to Marquette Properties and Lendlease.

Hundreds of millions of dollars’ worth of Brisbane CBD buildings are reportedly close to being sold, including a 50% interest in the $700 million development by Cbus Property and Nielson Properties of a 31-storey office tower at 205 North Quay, as well as the 22-storey 53 Albert Street tower that JPMorgan has been shopping around with an asking price of over $300 million.

According to JLL, the Brisbane CBD recorded 6,700 sqm of net absorption over the 12 months to the March quarter, and a number of stock withdrawals in the early part of the year helped bring vacancies down 0.6% to 14.9%. Property Council data shows office occupancy lifted for the third consecutive month in April, now sitting at 51% – behind only Adelaide.

Meanwhile, the deal is another backing of CBDs from Wingate. Early in the year it bought an eight-level, 589-bay car park in Sydney’s The Rocks precinct for $52 million from Mirvac. The assets is below the 40‐storey residential, office and retail building at 109‐111 Harrington Street.